People that want to use because of difficult currency finance nonetheless need to meet up with the qualifications place by lender. This type of tend to assortment however, normally were which have enough earnings and then make payments promptly. These firms take on greater risk financing, and that they should are able to lose the threats in these lending points.

You’ll find the best loan providers research for some other states to the our platform. An initial-time borrower is actually to shop for a little leasing assets in the Chicagoland urban area. As the property wasn’t turnkey, it merely expected light rehabilitation becoming book-able. The new borrower are better-accredited however, had problems securing an inferior mortgage out of his local neighborhood lender.

Do you have forgotten cash in Illinois? Here’s how to test to have unclaimed property and you may money

This is an excellent option when you have a bad borrowing get. the phone casino reviews After choosing a reputable difficult currency loan providers Chicago, such HardMoneyMan.com LLC, the next thing in the loan process should be to assemble and you can get ready the mandatory documents. As well, you may have to render documents on the one existing liens or mortgages to your property. It’s crucial that you assemble most of these data files in advance and you can have them prepared and able to submit to the lender. This will help improve the loan process while increasing the probability away from approval. The cost is actually $753,750 plus the restoration funds is $eight hundred,100000.

Personal Money Loan providers Hard Currency Finance inside the Chicago, IL

In the first place of New york, Zac has invested their whole professional profession inside Fl with assorted spots inside a property financing and broker, non-undertaking mention conversion process and loan origination. Zac is actually well equipped that have knowledge and experience across all aspects of one’s Florida real estate market. From the Renovo, we are going to make it easier to romantic rapidly and possess entry to pulls inside the twenty four in order to 48 hours to suit your investment fund since the, within the a house, time is that which you. Renovo Economic is over a loan provider, we’re your ex lover.

All Legal rights Set aside.By entry a type to your our website you commit to receive selling email address interaction from EquityMax. EquityMax features numerous consumers with many effective finance within our collection. EquityMax does not require all of our borrowers getting a company of LLC. We could originate money to people, LLCs, Businesses, Belongings Trusts, and Notice-Led IRAs.

Condition legislators contradict Chicago mayor’s desire for far more taxpayer bucks – Center Square

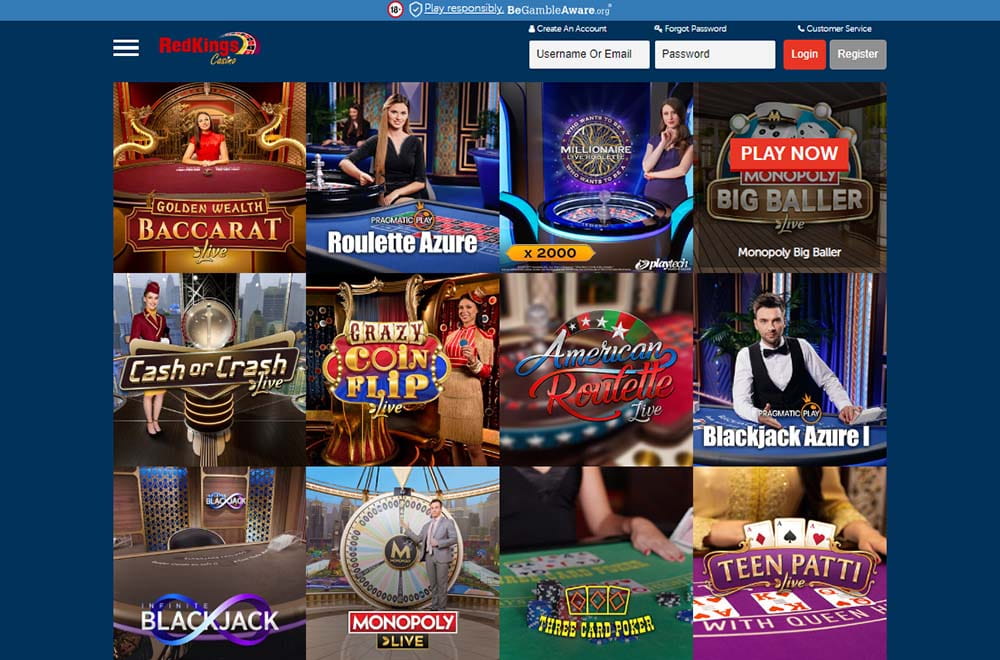

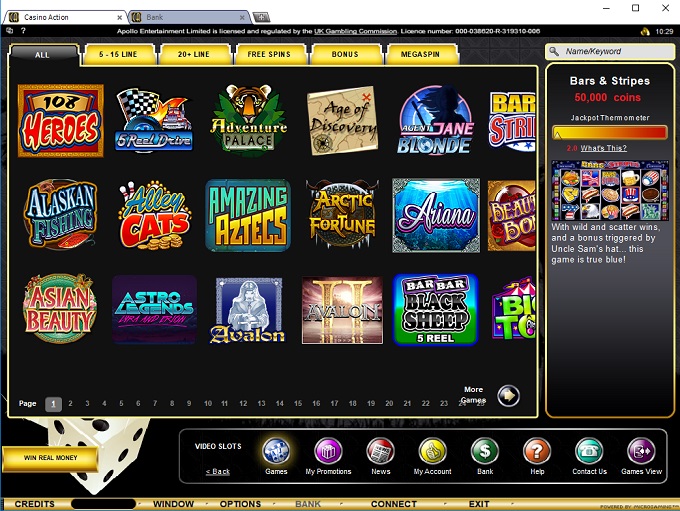

I mention what are and have fun with the better genuine-money web based casinos, along with nice greeting bonuses and you can enhanced mobile apps that will be within the legalize online gambling jurisdictions. Call us today to grow your a home portfolio with confidence. Chicago’s livability try a button factor for real estate people. The fresh city’s vibrant social scene, excellent public transit, and you may varied dining possibilities subscribe to their interest. At the same time, the brand new city’s commitment to system and you can societal characteristics after that enhances their livability. The current Chicago housing industry are seeing more sales, inflation, and you can coming down list.

S Colfax Ave Chicago IL 60617

These types of tough money financing try a variety of brief-label, high-interest financing specifically made to simply help the individuals looking to quick access in order to financing for purchasing an investment property or rehabbing you to already had. HardMoneyMan.com, LLC began lending on the financing characteristics to help you home people in the Chicago within the 1998. All of our niche try step one-4 tool homes which might be needing repair.

National Individual Lending’s Tough Currency Finance inside Chicago none of them private earnings files to meet the requirements and you will money are created beneath your corporation’s label. Businesses are not essential to include any earnings documents sometimes, they can be the new or experienced organizations. Find out more about our very own Chicago tough money software now, and put upwards a trip which have a pros. Chicago Bridge Financing & Chicago Long lasting Fund OptionsWe’re also here to help you grow your real estate industry!

Chicago’s housing market now offers lucrative potential for enhance and flip traders. Of a lot elderly features within the common areas try best candidates to own rehabilitation and you will resale. That it section of your business can be give extreme earnings to possess traders for the right experience and you will tips. Chicago, recognized for its varied neighborhoods and you may rich record, might have been feeling constant population gains historically. The new city’s people gains is actually determined by things including work potential, degree establishments, and you will social places.

Individual money lending could be the services you’re looking for. Around 1979 Obama become university during the Occidental inside the Ca. He could be very unlock in the their 2 yrs during the Occidental, he attempted all types of medication and you can is wasting his time however,, even if he previously an excellent head, did not use himself in order to their education. ‘Barry’ (that has been the name the guy used all their lifetime) during this time period got two roommates, Muhammad Hasan Chandoo and Wahid Hamid, one another away from Pakistan. In summer from 1981, just after his next year inside the college, the guy made a great ’round the new world’ trip. Closing to see his mom in the Indonesia, 2nd Hyderabad inside Asia, around three months within the Karachi, Pakistan in which he stayed together with his roommate’s members of the family, up coming out to Africa to check out their dad’s family members.

It permits the fresh debtor discover adequate money to purchase the brand new house and you may enough financing making fixes inside. This can help to cover the individuals larger fixes otherwise renovations one to the home you may consult. While you are rates of interest are large throughout these financing, individuals usually make use of other features, like the reduce commission conditions. Even though loan providers set their particular requirements, specific provide money to those who have just 2% of the conversion process cost of the property to place down on the purchase.